Taxes may not be the most scintillating topic, but let’s face it: they’re an undeniable part of our lives. Whether you’re a globetrotting digital nomad, an expatriate soaking up the culture in a new land, or simply someone curious about the world of tax forms, the W-9 and W-8 forms are your backstage passes to understanding the tax game. We’re about to embark on a journey into the intriguing world of taxes, where the “W-9 form is for non-US citizens” and the “W-9 form for US citizens” play starring roles. Don’t worry; we promise to keep it far from boring and closer to enlightening. So, fasten your seatbelts because we’re about to demystify these forms and unveil the secrets they hold in global finances.

If you are a digital nomad working for companies abroad, you might be confused about the documents you must fill out for US-based companies. You might be working remotely in Italy as a US citizen and only need to complete a W9. However, there are reasons why foreign individuals will need to fill out a specific W8 form. The W-9 form is for non-US citizens is known as the W-8, but there are five different types.

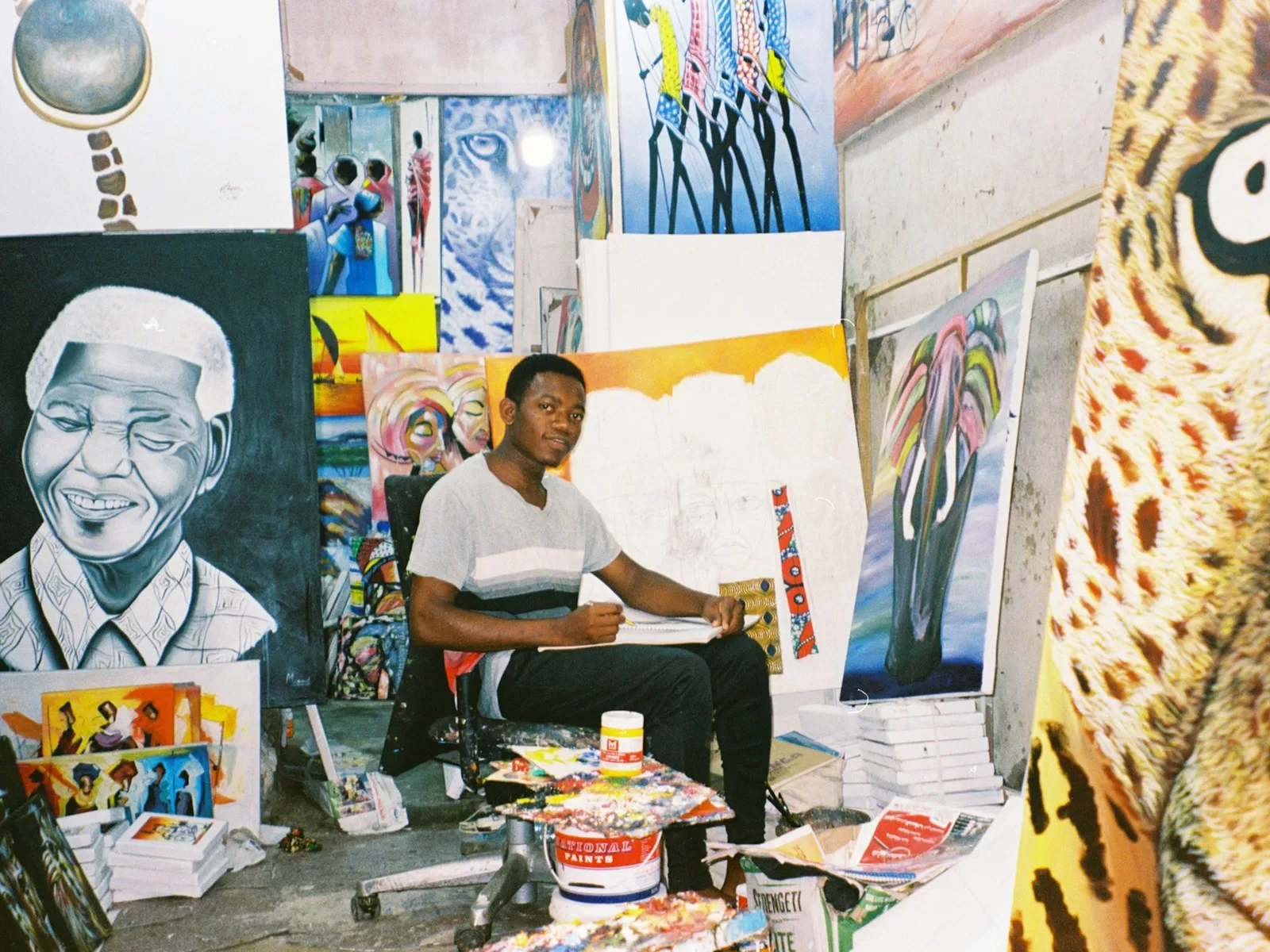

Welcome Back Vagabonds!

Welcome to “Atypical Vagabond,” a portal to a realm where boundaries blur and conventional paths diverge. Here, we delve into the world of unconventional exploration and celebrate the art of wandering without constraints. Join us as we uncover hidden gems, unravel the tales of unconventional nomads, and delve into the transformative experiences that await those who dare to embrace the call of wanderlust.

A strong desire for freedom often arises in a busy world of daily routines and societal pressures. We become fascinated by the exciting appeal of unfamiliar places, the mysterious call of undiscovered destinations, and the life-changing influence of travel. In these instances, we awaken the spirit of the unconventional traveler — the wanderer who desires to explore the world and embark on a journey of self-discovery and personal freedom.

Organizations operating within the US must have a valid tax identification number to report earnings paid to customers. Therefore, this method for data collection varies from firms based in the US to firms abroad if it runs in the USA. It is essential to store each supplier’s accurate W Series identification information to ensure compliance with the federal code. The company must then be able to use standardized methods to collect relevant data from all of its suppliers.

In Europe, there is an EU VAT where their citizen’s home countries provide VAT numbers. Many highly qualified individuals want the best digital nomad jobs. However, these jobs are often in the US and must meet US tax law.

International students in the US may want to know how to maintain residency. Remaining compliant means they must show the US government their source income with the IRS tin. Therefore, when a supplier identifies the income reported in a tax year on a form W 8, they can be in good standing.

The tax identification of US entities is the FEIN or Federal Employer Identification Number. However, sometimes referred to as EIN or employer identification numbers, force companies based in the US to remain compliant. Therefore, the number is for a business making payments for its capital gains.

Foreign Tax ID Status

As an independent contractor, you must understand which W forms are necessary for 1099 employment. Independent contractors will need to fill out the proper form before beginning work. However, we will make this straightforward.

Depending upon your citizenship will determine how you will need to file your US forms. The most confusing part of your foreign tax status can be the specific identifying numbers. The two types of classifications are TIN and ITIN, and we will discuss the differences. It will also help you determine whether an individual needs to fill out a W8 vs. W9 form.

What is the Taxpayer Identification Number?

The use of a Taxpayer Identification Number (TIN) by the Internal Revenue Service (IRS) is to administrate tax laws. It is administered either by the Social Security Administration (SSA) or the Internal Revenue Service. The SSA publishes a Social Security number (SSN), whereas the IRS issues all other TINs.

The withholding agent will process non-US tax resident forms using the tax identification information. Depending upon the tax treaty will declare how much tax you owe.

Taxpayer Identification Numbers

- Social Security number “SSN.”

- Employer Identification Number “EIN“

- Individual Taxpayer Identification Number “ITIN“

- Taxpayer Identification Number for Pending US Adoptions “ATIN“

- Preparer Taxpayer Identification Number “PTIN“

What is the individual taxpayer identification number?

An Individual Taxpayer Identification Number (ITIN) is a processing number disseminated by the Internal Revenue Service. The IRS presents ITINs to people with US taxpayer identification numbers.

Although these individuals do not have or are not qualified to acquire an SSN from the SSA.

The IRS allocates ITINs to assist individuals in complying with US tax laws. Therefore, it delivers a means to efficiently process returns and payments for those not eligible for Social Security numbers. The ITINs are issued regardless of immigration status because resident and nonresident aliens may need to file or report earnings under the Internal Revenue Code. ITINs do not perform any purpose other than federal reporting.

An ITIN does not:

- Authorize work in the US.

- Provide eligibility for Social Security benefits.

- Qualify a dependent for Earned Income Credit Purposes.

If you are a US person, you are required to fill out Form W-9.

W-9 forms confirm American tax residency status. All foreign banks in a member state of FATCA must provide an official statement to the client, ensuring the person is American. The IRS can use this form to estimate the tax owed to an independent contractor who provides work to an organization or specializes in other business activities. Likewise, it exempts businesses from withholding taxes or paying taxes independently.

What is a W-9 Tax Form?

The official name for Form W-9 is the ‘Request for Taxpayer Identification Number and Certification form. The W-9 form is also for non-US citizens but known as a W8, which we will get to shortly. Businesses utilize the state to collect information from independent contractors, freelancers, and vendors. These individuals are US citizens and are required to pay US taxes.

Quick recap: If your business disburses $600 to a freelancer annually, you must report these payments to the IRS via Form 1099-NEC. However, it is not a requirement for companies to withhold income tax. Businesses do not pay freelancers Medicare or Social Security benefits. The IRS will want to understand how much these workers earned to ensure they deliver the correct amount in self-employment taxes.

W9 Tax Withholding

So, the W-9 helps businesses gather all the information they need to fill out the 1099-NEC correctly. The data will include the following:

- Name

- Address

- Social Security number (SSN) or tax identification number (TIN)

The use of form W-9 is only to gather the necessary information. You, the business, and your contractors should only submit the W-9 to the IRS.

W 9 Form for non-US Citizens

Depending upon the tax treaty will determine how an individual pays taxes. A foreign person will need to know which W8 they need. Non-US tax residents from different countries must complete the proper form for the appropriate calendar years. Therefore, they will not fill out the W9 tax form as independent contractors.

Don’t worry, though, as it is pretty straightforward.

What are W-8 series tax forms?

Buckle up, friends. The W-8 series tax ID forms are thornier than the W-9. However, it is critical to understand if you work with non-payroll workers who are not US citizens and US citizens who reside outside the US.

Non-US residents use W-8 forms to prove their foreign status to claim treaty benefits.

It is essential to note that the US has different tax treaties with other countries worldwide, meaning withholding amounts differ for freelancers depending on their land.

So, after receiving a W-8 form, use the W-8 form to calculate how much money to withhold. Suppose a non-US citizen, nonresident alien freelancer, paying companies, and withholding agent contractor fails to submit the form. In that case, they must pay a total tax rate of 30% that ordinarily applies to foreign entities.

Still with me?

There are five different W-8 forms, which make it a little more complex to manage tax requirements for entities that declare a tax status. Foreign freelancers can fill out only some of the five forms, however. They need to determine the proper form based on their type of business and purpose.

The Five Types of Form W8

Here we will provide you with the five different types of Form W-8.

W-8BEN

The most commonly used W-8 form is the W-8BEN. The full name of the form is the ‘Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting,’ The document aims to establish if the individual filling is out of a foreign individual. The owner of the business in question must fill out this form. Foreign individuals are subject to a tax rate of 30% on their income from US payers. The form assists workers in claiming a reduction or exemption from US withholdings if they live in a country with a tax treaty with the US, and the income they receive is subject to that treaty.

W-8BEN -E

The formal title of this form is known as the ‘Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting.’ The document is similar to the W-8BEN, except foreign businesses and not individuals utilize this form.

W-8 CI

The full name of the form is the ‘Certificate of Foreign Person’s Claim for Exemption From Withholding on Income Effectively Connected With the Conduct of a Trade or Business in the United States.’ If foreign individuals receive income from US-based payers, they must fill it out after engaging in any business or trade.

It’s important to note that ECI is not subject to the same 30% withholding rate. Instead, after subtracting relevant deductions, it is taxed at the graduate rate to US citizens, and resident aliens are subject. If a US treaty covers the type of income/country of residence, the tax rate would be the lowest rate under that treaty.

W-8 EXP

The full name of the form is titled ‘Certificate of Foreign Government or Other Foreign Organization for United States Tax Withholding and Reporting.’ Foreign governments, foundations, and tax-exempt organizations typically use the utilization to reduce withholdings by claiming an exemption. The entity must meet the specific codes to qualify. Otherwise, it must file a W-8BEN or W-8ECI: code 115(2), 501(c), 892, 895, or 1443(b).

W-8IMY

The full name of the form is the ‘Certificate of Foreign Intermediary, Foreign Flow-Through Entity, or Certain U.S. Branches for United States Tax Withholding and Reporting.’ Intermediaries use it to warrant that an individual or business obtained tax-withholding income on behalf of a foreigner or as a flow-through entity.

Like the W-9 form, you should not present W-8 documents to the IRS. Instead, those who obtain the payments should submit them to you.

These tax forms are critical to appropriately fill in the 1099 NEC and 1024-s tax forms that all companies working with freelancers must submit to the IRS.

W8 vs. W9: What’s the difference?

If you need more clarification, here are the different types of forms. The list should provide some of the quick questions you may have about the documents.

- US workers fill out Form W-9 with their SSN or TIN. While foreign individuals and nonresident aliens should fill out W-8 forms, who receive earnings from US sources.

- Form W-9 is a single form, but there are five types of W-8. The kind of W-8 a freelancer or vendor should fill out depends on their earnings.

- The W-8 form’s goal is to provide the IRS with the ability to track how much profits are sent to entities overseas. It also allows the appropriate withholding rate.

- The W-9 form goal is to ensure self-employed individuals in the US pay the proper taxes.

When and How Should you Collect These Forms?

Good question. Here’s an overview of the process for both forms.

Forms W-8

Non-US contractors, freelancers, and vendors should provide the completed W-8 form before you give any payment. If they delay submitting the form, you might need to withhold 30% under US tax law.

The best practice is to inform foreign freelancers to submit the proper W-8 form during onboarding. Therefore you have all relevant documentation in one centralized place before issuing their first payment.

Once submitted, W-8 forms are adequate for the year they are signed and three years afterward. For example, a W-8 form signed on July 1, 2022, would be valid through December 31, 2025.

Form W-9

It would help if you collected a Form W-9 from every new freelancer or vendor. Therefore, onboarding is the best time to get all the legal requirements out of the way. If the freelancer or vendor’s information changes, they should submit a new W-9 to you with the updated information.

You will only sometimes know how much you must pay them because you were able to receive a W-9 early. For example, most freelancers should provide a W-9, but they will only get a 1099-NEC if you pay them less than $600 in the calendar year.

Ensure not to Mix up Forms W8 and W9.

The different tax forms correspond with specific requirements. Therefore, they could be more complex and get overwhelmed. Breaking the forms down piece by piece hopefully assisted in you gaining a greater understanding of the specific conditions, and managing your workforce becomes easier.

You will need to deal with greater clarity on the various tax forms. Your company will be better equipped to work with freelancers in the US and worldwide.

Atypical Last Thoughts

In the ever-expanding realm of international work and living, the intricacies of tax obligations can become a labyrinthine challenge. However, at the heart of this fiscal complexity, two critical forms serve as the compass in this unfamiliar terrain: the W9 and W8. Though distinct in their purpose, these seemingly mundane documents are pivotal in ensuring that your financial affairs remain in good order while working abroad.

Know the W9 Form

The W9 form, predominantly utilized in the United States, is fundamental in establishing your taxpayer identification number (TIN). After reading this document, you should know that the w-9 form is not for non-US citizens. You will need to file a W8 form. This innocuous-looking piece of paper carries immense weight, providing the government with essential information about your financial activities. Whether you’re an independent contractor, a freelancer, or simply receiving income abroad, the W9 is the linchpin enabling accurate earnings reporting. It’s the conduit through which tax authorities can identify and monitor your financial transactions, making it indispensable for individuals and businesses operating internationally.

Know the W8 Forms

On the other side of the ocean, the W8 form takes center stage for those venturing into foreign lands. This document serves as your declaration of alien status for tax purposes, allowing you to assert that you are not a U.S. taxpayer. For expatriates, foreign nationals, or anyone receiving income from U.S. sources while residing outside the country, the W8 form is the shield that safeguards against unnecessary tax withholdings. By providing this document to your financial institutions and withholding agents, you assert your right to benefit from tax treaties and avoid double taxation, ultimately preserving more of your hard-earned income.

Know Your Situation Abroad

As you embark on the adventure of living and working abroad, whether in the enchanting landscapes of Germany, the culinary delights of France, or the serene surroundings of Sweden, understanding the nuances of tax regulations is paramount. You will need to know if you need a w-9 form for non-US citizens, a w-9 form for US citizens, or the W8 form. Each of these nations possesses unique tax codes, deductions, and exemptions. Expatriates must navigate these intricacies to ensure financial compliance and peace of mind. By embracing the significance of W9 and W8 forms and acquainting yourself with your host country’s tax landscapes, you can confidently embark on your international journey, knowing that your fiscal responsibilities are well-handled. This, in turn, allows you to fully immerse yourself in the adventures and experiences that await your chosen destination.

Subscribe

Are you an avid traveler seeking inspiration for your next adventure? Look no further than the Atypical Vagabonds newsletter. By subscribing to our newsletter, you gain access to a treasure trove of travel tips, destination guides, and captivating stories from around the globe. Our expertise in exploring off-the-beaten-path destinations. We offer a refreshing perspective on travel, encouraging you to embrace the unconventional and discover unique experiences. Join the community today and let our wanderlust-inducing content inspire you. Therefore, you can embark on extraordinary journeys. Subscribe to receive their latest updates directly in your inbox and never miss a travel adventure again.

Donations

Love what you’re seeing on Atypical Vagabond? Help us keep the adventures coming! Consider donating through PayPal’s secure payment system. Every contribution goes a long way in fueling our mission to bring you more thrilling content and unforgettable experiences. Join us in shaping the future of travel—donate today!